Articles

If your occupant titled from the book moves out, the remainder renter does not have any to continue inside the occupancy instead the new property owner’s show agree. It’s illegal to own a property manager in order to restriction occupancy of an apartment to your called renter in the rent or even to one to tenant and you will quick members of the family. In the event the rent names only one renter, one occupant get show the brand new flat having instantaneous members of the family, one to extra renter, and also the tenant’s dependent college students considering the new occupant or the renter’s partner takes up the brand new site as his or her number one household. If rent brands multiple renter, this type of clients will get display its apartment that have immediate members of the family; and you will, if one of one’s renters titled on the lease moves away, you to definitely occupant can be substituted for various other renter and the centered college students of your own renter. A minumum of one of one’s tenants named in the book otherwise you to tenant’s mate need take the brand new mutual apartment while the a first home. If the property owner purposely holiday breaks which legislation, the newest occupant can be entitled to as much as double extent of your defense deposit.

If you are saying the college tuition itemized deduction to get more than just about three students, fill in another declaration together with your Mode They-203-B. As much qualified expenses expenses invited for every qualified scholar are $10,100000. But not, there isn’t any limitation for the level of qualified students to possess who you get claim the newest itemized deduction.

Unique accruals to own full-season nonresidents

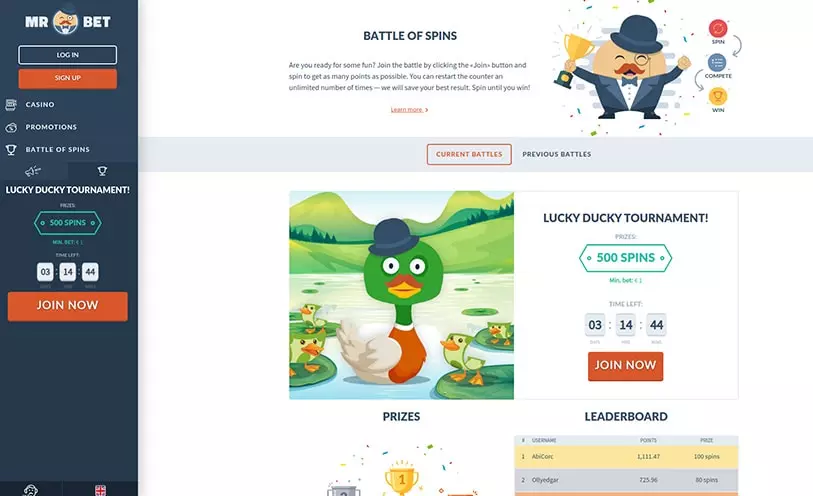

Some web based casinos which have $5 lowest deposit bonuses can get limit your added bonus finance to particular video game, that’s common amongst totally free spins incentives. For this reason, i encourage meticulously discovering the newest T&Cs and you may knowledge and this online game you could play having fun with extra money. Particular games matter one hundred%, while others might only lead the lowest commission, and many will most likely not even count at all. 100 percent free spins incentives allow you to twist the fresh reels away from a good slot games without the need to bet many own currency. While you are betting platforms have a tendency to were these types of in the greeting packages, you can even discovered them as a result of certain lingering offers.

On the nonresident several months, estimate the newest NOL utilizing the a lot more than laws and regulations to possess nonresidents. Payments for an eligible college student from a qualified condition tuition program (including Ny’s 529 college savings system) are thought certified university fees expenses to have reason for the school tuition deduction. For those who allege the newest pupil since the a depending, such costs are addressed since the paid off on your part. Qualified scholar has the fresh taxpayer, the new taxpayer’s spouse, and the taxpayer’s centered (to have whom an exception for new York State tax aim is acceptance).

Have always been I entitled to score my personal security put back if i crack my rent?

B. And the treatments against the occupant subscribed through this section, a landlord will get connect with the newest magistrate for a guarantee to possess trespass, provided the brand new guest otherwise invitee might have been supported in common having subsection A great. In the event the including a property manager does not comply with the fresh conditions of which subsection, the fresh applicant for tenancy will get get well statutory damage away from $step 1,100000, as well as lawyer charge. The newest renter, when the in the palms, has paid for the courtroom the level of rent discover by the court becoming due and you may delinquent, becoming held from the legal pending the brand new issuance from an enthusiastic order under subsection C.

Both spouses have to sign a shared come back; we simply cannot procedure unsigned production. On the areas considering towards the bottom from web page 4, signal and you can date your own unique come back and go into your profession. To learn more, see Mode It-2105.9, Underpayment out of Projected Income tax by the Anyone and you will Fiduciaries as well as tips.

A great Canadian company is in charge of repairing busted freight bins and you may conveyances belonging with other carriers because the pots or conveyances are in the new Canadian carrier’s hands. The new Canadian provider have a tendency to statements who owns the package or conveyance for the resolve features offered. These vogueplay.com best term paper sites types of fix features, as well as pieces, is no-rated when they are charged to a low-citizen service provider. Exports of most property and you may characteristics of Canada are zero-ranked (taxable in the rates from 0%). Therefore, as long as specific requirements is actually satisfied, you will not pay one GST/HST to the assets or functions shipped for your requirements of Canada. Self-analysis of your own GST/HST applies to nonexempt imports of functions and intangibles ranging from separate branches of the identical person.

Keep a duplicate of your own income tax details

“H2o and you can sewer submetering gadgets” form products familiar with level actual water otherwise sewer usage in the any residential strengthening whenever including gizmos is not had or regulated because of the electricity and other supplier from h2o or sewer provider that provide services on the domestic building. “Apparent proof of mold” function the presence of shape regarding the house unit which is noticeable to the newest naked-eye by landlord or occupant in the portion inside the interior of the structure equipment readily available in the enough time of your own disperse-inside the assessment. “Tenant info” mode the information, and economic, repair, and other info on the a renter or potential occupant, whether such as information is inside created otherwise electronic mode otherwise any almost every other typical. “Rental software” setting the new created app otherwise comparable document used by a landlord to choose if a possible renter is competent to end up being a renter out of a dwelling equipment. “Controlling broker” function anyone authorized by the property owner to behave while the property owner with respect to the brand new property owner pursuant for the composed possessions administration contract. Chase Individual Buyer Checking also offers a plus as high as $3,100000 to possess beginning an alternative membership.

- The degree of the brand new payment isn’t set by-law and will likely be discussed between your functions.

- Penelope Rectum, 26, from Augusta, Georgia, are arrested and you may charged with seven counts away from fingers of man intimate punishment matter, with regards to the Leesburg Cops Department for the Saturday, Summer 31.

- If the earning a lender signal-right up extra requires placing over $250,100000 (the simple amount one’s insured by the Federal Put Insurance Corp.), you’ll have to use specific ways to make sure that all your money — as well as fund more $250,one hundred thousand — is actually protected.

- There are things you can do to restrict just how much from their deposit try employed.

- Similar to this, getting purchased playing your favorite video game is a good idea even if you are making a low $5 min deposit.

- Fill in as numerous Forms 1099-Roentgen as you need to help you declaration all the Models 1099-Roentgen you gotten.

While this account inhibits you against overdrawing usually, there’ll nevertheless be times when your bank account have an excellent negative balance. This could occurs when the total number of an exchange varies in the matter that was to start with subscribed, such whenever a guideline are placed into a cafe or restaurant fees. For everyone Lender out of The usa profile, there is absolutely no payment to possess Expenses Spend Services for those who’re also enrolled in On the web Banking. Under the CMEPA, the capital development income tax on the sales, exchange, or transfer from shares in residential and you may overseas firms try now evenly labelled from the 15%. Ahead of CMEPA, desire earnings is susceptible to many income tax cost—of fully excused so you can all the way to 20%—with respect to the taxpayer, the main cause, plus the name out of readiness, and others, performing extreme confusion. When you are big foreign traders can merely move to help you neighboring nations having lower if any inventory transaction taxes, local retail investors are left to your quicker glamorous options away from sometimes results the duty away from highest friction will cost you otherwise reducing their change frequency.

And you can half a dozen a good.yards., per apartment have to be hot so you can a fever with a minimum of 55°F. (Numerous House Laws § 79; Several Household Rules § 173; Nyc Administrator. Code § ). Several dwellings founded otherwise converted to including play with prior to January step 1, 1968 along with must have notice-securing doors and you may a-two-means intercom system if asked from the a lot of all the apartments. Landlords can get recover the price of getting that it devices of clients (Several Hold Law § 50-a). Inside the performing one works one to inhibits direct-based color inside appropriate renting and you may popular parts, a property manager need get experts who have completed a program within the lead-secure work methods.

You need to fill out the newest completed credit models and you will Function They-203-ATT with your come back. For those who utilized Function They-230, Region 2, you need to finish the Nonresident and you may region-12 months resident money percentage schedule from Function It-230-I, Instructions to possess Setting They-230, to determine the funds fee to go into online forty five. When you are in addition to claiming the newest impairment money different (Function It-225, S-124), the total of your own your retirement and you can annuity earnings exception and you will disability income exception usually do not exceed $20,100000.

Simultaneously, specific groups and you will communities, including certain provincial and you may territorial governing bodies, don’t constantly pay the GST/HST on the purchases. To find out more, discover Guide RC4022, Standard Advice to have GST/HST Registrants. You will want to choose a cards connection over a financial for those who discover certain account or features that are ideal for your goals. Many of the borrowing unions searched has highest-give bank account, if you find a merchant account which fits what you are looking to own, you won’t feel like you are diminishing because there are fewer items and you can features.

Leasing Defense Deposit Calculator Information

If the landlord receives from a renter a written ask for an authored report away from charge and you may money, he will deliver the occupant that have an authored statement proving the debits and you can loans along side tenancy or the earlier 1 year, almost any are reduced. The newest landlord shall render such as composed report inside ten business days of choosing the brand new demand. The fresh written find from denial should are the statewide courtroom aid telephone number and you will web site address and you can will upgrade the new applicant you to he need assert his right to challenge the brand new assertion inside seven times of the brand new postmark day. If your property owner cannot discovered an answer regarding the candidate inside 1 week of one’s postmark date, the newest property owner get go-ahead. The brand new property manager must be able to verify the new time and date you to definitely any communication delivered by electronic or telephonic setting are delivered to the applicant.

So you can be eligible for that one-go out brighten, you’ll have likely to arrange lead put to your bank and maintain the newest membership unlock for at least two months. Our very own finest required casinos on the internet having $5 lowest put bonuses may also have fair betting episodes, normally as much as one week. This gives people a decent amount of your energy to love the newest extra and match the requirements earlier becomes void. If you’re to try out in the a genuine money internet casino, the next thing is to make the minimum put limitation needed to allege the advantage. While you are indeed there’s however vow that the $500 and you will $300 monitors have a tendency to arrived at New york residents in the 2025, logistical and governmental waits is actually preventing one firm timelines out of getting set.