Posts

One to earnings may be subject to chapter 3 withholding income tax, because the discussed earlier. An application W-8BEN otherwise a form 8233 provided by a great nonresident alien to help you get pact pros doesn’t need a good U.S. TIN for individuals who, the newest withholding agent, meet all of the after the criteria. Global teams are excused of U.S. tax to your all U.S. origin earnings. Income paid off in order to a major international organization (in the concept of section 7701(a)(18)) isn’t at the mercy of chapter step three withholding. Global groups are not needed to render a questionnaire W-8 or documentary facts for the fresh exception if the term of the payee is just one which is designated because the a major international company from the government buy.

If the someone are a foreign disperse-because of organization otherwise a foreign mediator, your implement the fresh payee dedication legislation compared to that partner to decide the new payees. Essentially, a supplier who is a have a peek at these guys good nonresident individual need file a Maine taxation get back for the income tax season where the fresh selling of the Maine possessions occurred in order to determine any Maine taxation owed or overpaid. A return is not needed if your money acquire in the selling, and almost every other Maine-origin nonexempt money, cannot result in a good Maine taxation responsibility. One allege for refund out of an enthusiastic overpayment out of withholding have to be filed within 36 months in the due date of your return or 36 months ever since the newest tax are paid, any type of expires after. For additional info on the fresh Maine submitting standards, find Maine Code 806, the brand new Faqs to possess individual tax (Matter 6), plus the tips to possess Form 1040ME and you will Agenda NR or NRH in the /cash.

If the wide open areas are more your style, you might consider committing to undeveloped home instead structures, paths, plants, or resources. It’s always less to buy, and a land loan will help you in the developing it. When you are risky, house flipping can lead to a hefty salary when you sell, which you are able to next use to invest in your next possessions. Some other champion has been commercial home, supercharged from the pandemic-driven growth in the elizabeth-commerce.

Advantageous Money and Income tax Pros

The partnership, otherwise a withholding broker to the union, need to pay the fresh withholding income tax. A partnership that has to afford the withholding income tax however, doesn’t take action could be responsible for the new commission of your tax and you can any charges and attention. If you make a great withholdable payment so you can an entity stating certain chapter cuatro statuses, you are required to get and you will be sure the newest entity’s GIIN up against the composed Internal revenue service FFI listing within 90 days to help you rely on including a declare. Come across GIIN Verification below Requirements of real information to own Reason for Section 4, prior to, by which chapter cuatro statuses want an excellent GIIN.

What exactly do You need to Return In the A home?

That being said, Return on your investment computations are merely one to tool inside the comparing possible investments. Location, assets reputation, market fashion, and your investment schedule the play important jobs in how winning you happen to be. FinCEN solicited touch upon the fresh Advised Code and its revealing design—comments try due from the April 16, 2024. All-bucks requests from domestic a property are considered during the high-risk for cash laundering. The new code won’t need the revealing from transformation to individuals.

REITs are bought and you may in love with the major exchanges like any almost every other inventory. You can find a good a house sale by being really-told on the market style and financial outlooks. The greater amount of training you’ve got of one’s housing market and regional portion, the higher informed your behavior was.

Must i end up being an accredited trader to use actual house paying apps?

No home loan insurance to your financing with no constraints to own prepayments. Is close 3 months before the start of a new salary protected job having fun with one to income in order to meet the requirements. Provide funds from partner greeting to own closure costs / prepaid expenses or downpayment.

Hard Money Money, Domestic

The organization is the owner of flat products during the The new The united kingdomt, the new York Town metropolitan area, Washington, D.C., Seattle, and you will Ca. The company is the third-premier proprietor out of rentals in the You.S., with a profile measurements of nearly 80,one hundred thousand flat equipment over the says. Particular famous characteristics owned by the business were Avalon North Channel, Avalon West Hollywood, and you will Avalon Glendora. Let’s state you purchase property to own $250,100 which have 20% off, otherwise $fifty,100000.

Home shared fund invest primarily in the REITs and you can a home operating enterprises. They offer the capacity to acquire diversified contact with home with a somewhat handful of funding. Dependent on their strategy and you will variation needs, they give traders with far larger advantage choices than just will be attained because of to shop for private REITs. Investment organizations (REIGs) is sort of such as short common financing for rental functions. If you’d like to individual a rental possessions however, wear’t wanted the hassle of being a property owner, a real home financing class could be the solution to you personally. REITs buy many different services for example centers (from the a quarter of all the REITs concentrate on this type of), hospitals, mortgages, and you can work environment property.

- Home also provides of many possibilities and you will incredible taxation pros.

- The brand new WT must keep back on the go out it creates a distribution from a good withholdable payment otherwise a price susceptible to chapter 3 withholding to a direct international beneficiary otherwise manager.

- To possess a price understood paid back to an excellent transferor that is an excellent grantor trust, a broker could possibly get similarly dictate its withholding taking into account any withholding exception relevant to a good grantor or owner from the believe.

- While you are reporting amounts withheld by the another withholding agent, Setting 1042-S requests the name and you may EIN of your withholding broker you to withheld the fresh tax for the extent required in the brand new Guidelines for Setting 1042-S.

- If the characteristics are executed partially in the usa and you can partially beyond your Us because of the a worker, the brand new allotment away from shell out, aside from particular fringe pros, is determined for the a period base.

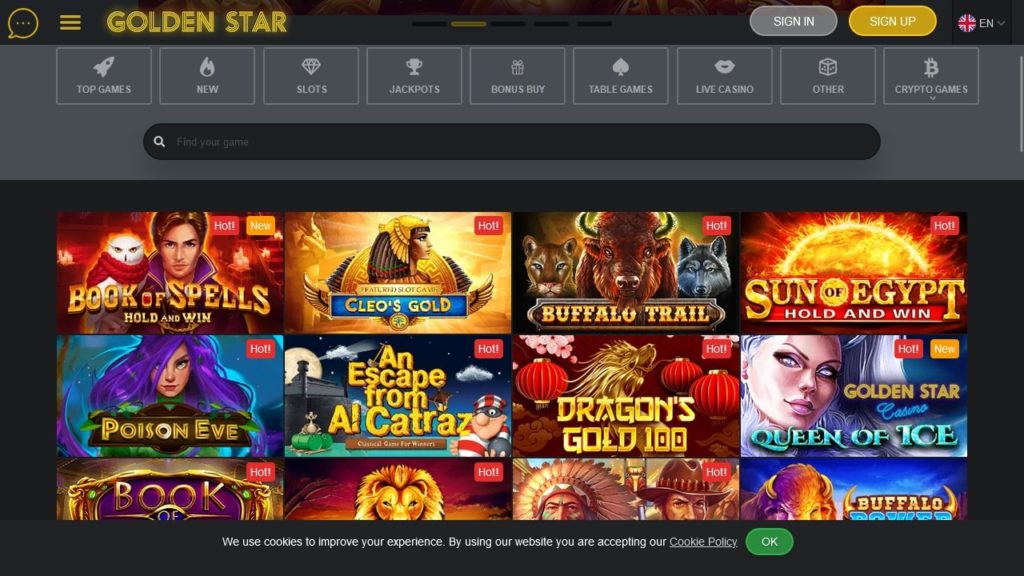

BetRivers Poker is the latest release so you can an already illustrious offering of web based poker providers within the Pennsylvania. Suitable web site to you personally have a tendency to mostly confidence the newest county in which you real time. Such, for many who’re inside the Las vegas, nevada, then WSOP.com ‘s the merely online game in the city. However, for those who’re in the Michigan, you could choose from WSOP.com, BetMGM, and you can PokerStars United states, which at the beginning of 2023, combined user pools which have Nj-new jersey. Let’s plunge in and give you a listing of the new finest a real income poker websites available to Us players in the 2025.

You can rely on documentary proof as opposed to a form W-8 to have an amount paid back outside of the Us with respect to help you an overseas obligation. Make reference to Offshore financial obligation, later, to decide whether a cost qualifies as a result a payment. A personal foundation which had been composed otherwise structured beneath the laws out of a foreign nation is a foreign individual foundation.